Are you interested in investing in junk bonds but unsure where to start? The New York Times (NYT) has a reliable rating system that can help guide your decision-making process. With their expert analysis, you can make informed choices about your investments.

Before diving in, it’s important to understand what junk bonds are. These are high-yield, high-risk bonds issued by companies with lower credit ratings. The higher risk associated with junk bonds means they offer higher returns to investors willing to take on that risk.

rating for junk bonds nyt

Rating for Junk Bonds NYT

The NYT rating system evaluates junk bonds based on various factors such as the issuing company’s financial health, market conditions, and overall economic outlook. By considering these factors, investors can gauge the level of risk associated with a particular junk bond.

Using the NYT rating for junk bonds can help you make more informed decisions about your investment portfolio. Whether you’re a seasoned investor or just starting out, having access to reliable information can make a significant difference in the success of your investments.

While junk bonds can offer higher returns, they also come with higher risks. It’s essential to diversify your portfolio and not put all your eggs in one basket. By using the NYT rating system as a valuable tool in your investment strategy, you can navigate the world of junk bonds with confidence.

In conclusion, the NYT rating for junk bonds provides investors with a valuable resource to assess risk and make informed investment decisions. By leveraging this rating system, you can navigate the complexities of the bond market and potentially enhance your investment returns.

Junk Bonds Stage A Comeback As Investors Regain Risk Appetite The New York Times

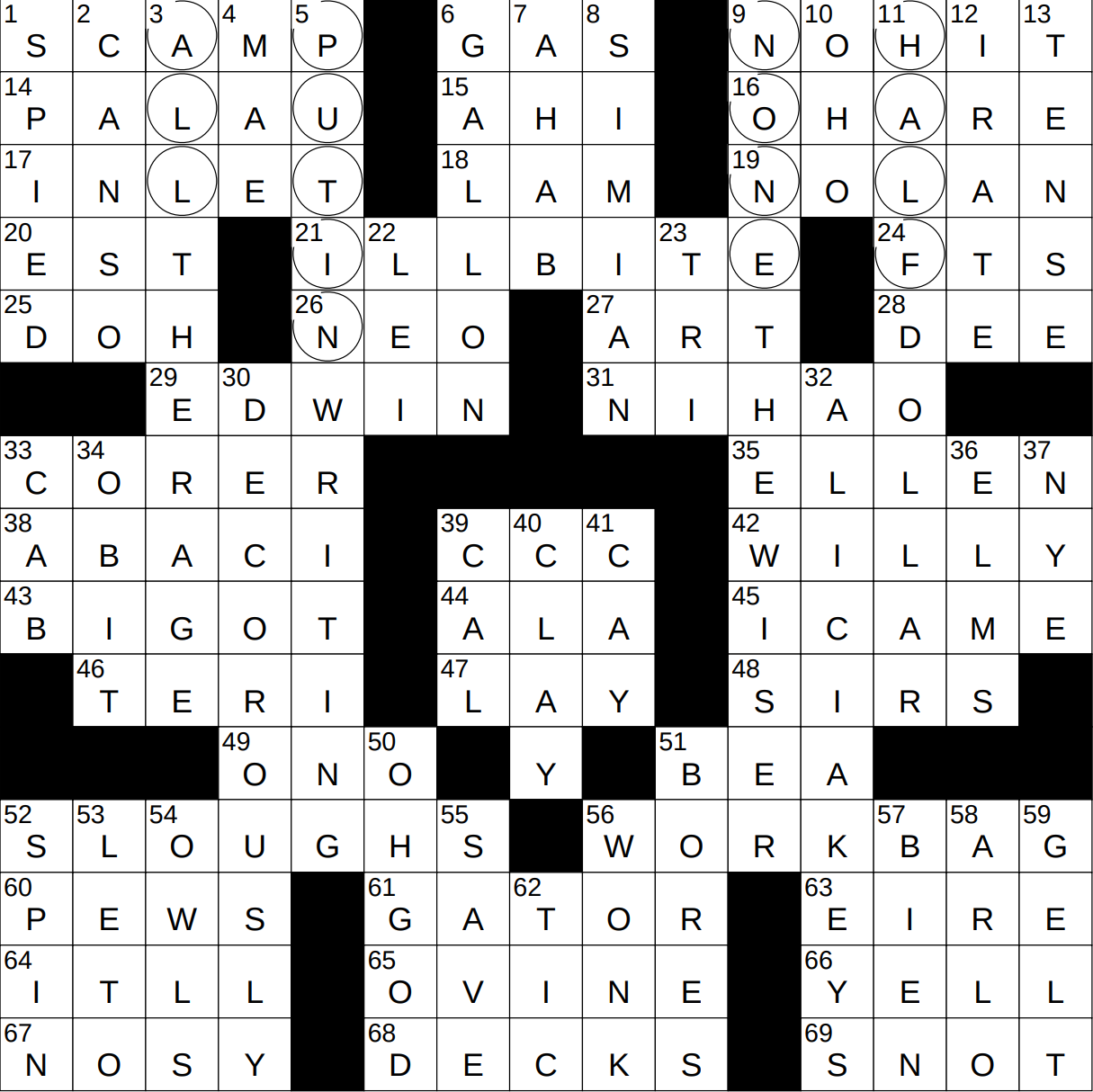

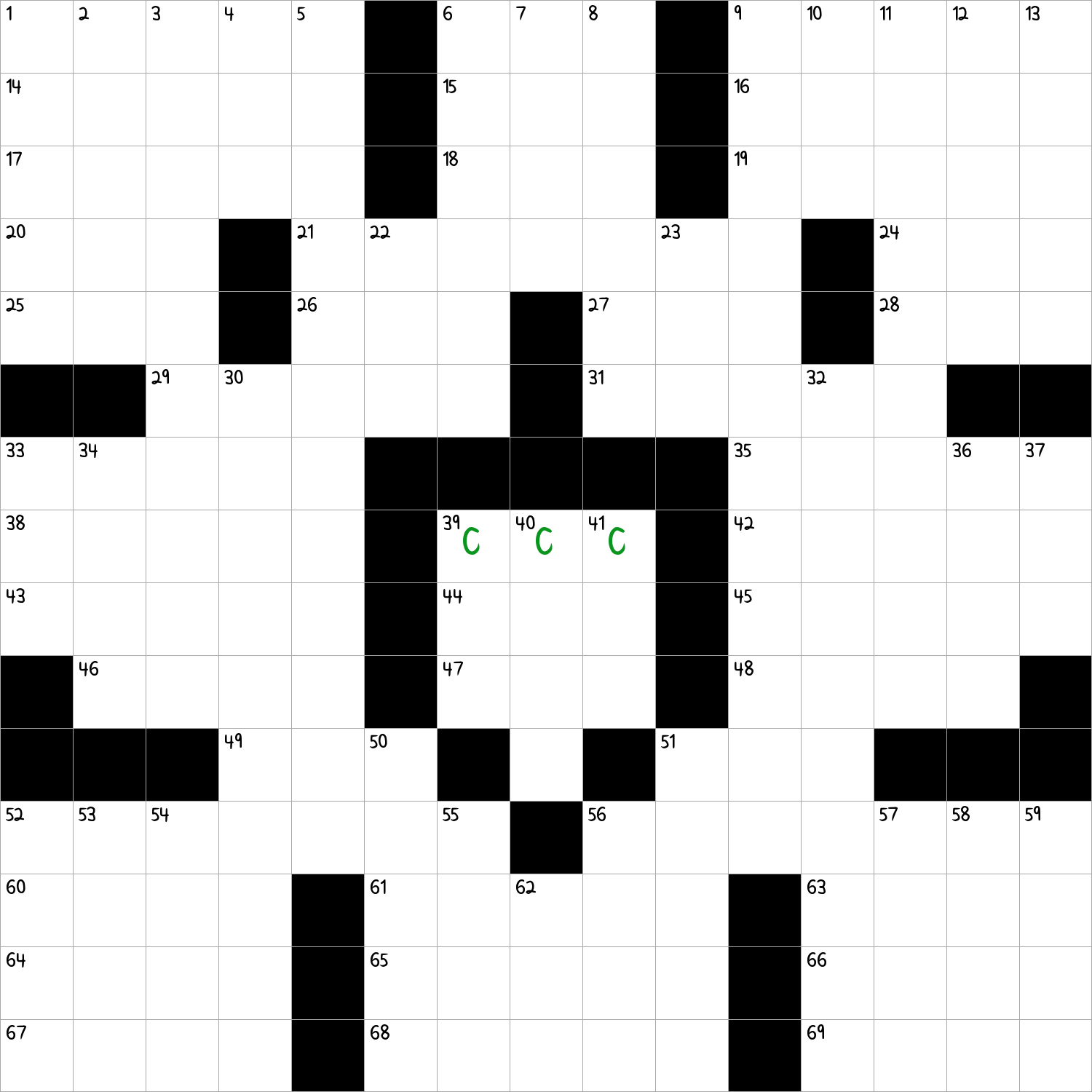

0101 25 NY Times Crossword 1 Jan 25 Wednesday NYXCrossword

Junk Bonds Grow More Popular And Turn Even Riskier The New York Times

Junk Bonds Never Stodgy And Steadier Than You Might Think The New York Times

Rating For Junk Bonds NYT Crossword Clue January 1 2025